Property in a Self Managed Super Fund

You can only buy property through your SMSF if you comply with the following rules:

- The property must meet the 'sole purpose test' of solely providing retirement benefits to fund members

- The property must not be acquired from a related party of a member

- The property must not be lived in by a fund member or any fund members' related parties

- The Property must not be rented by a fund member or any fund members' related parties

However, your SMSF could potentially purchase your business premises, allowing you to pay rent directly to your SMSF at the market rate.

The main benefits of buying property through a SMSF are the tax concessions.

The fund will pay a maximum 15% tax on rent from the property, and any capital gain made upon the sale of properties. Additionally, if a property is held for longer than 12 months the Super Fund receives a one third capital gains tax discount, meaning that the net capital is effectively taxed at only 10%.

Additionally, the Federal Government eliminated all taxation within superannuation once in the pension stage, meaning that rental income and capital gains from the property will be tax free once the fund is converted from accumulation phase into a pension fund. With the ability to now borrow in superannuation, the astute investor can leverage his or her superannuation and borrow to purchase property that will become tax free when pensions are established.

While working and paying tax the investor can negatively gear a good capital growth property out of his or her pre-tax income in the same way as if it was purchased outside super. The 9.25% superannuation guarantee can even be used to fund the negative gearing. The big difference occurs after age 60 when the property in super will attract no tax on rental income or net capital gain income on sale of the property once it has been converted to the pension phase. Payments from the super fund to the investor are also tax free, and superannuation pension income does not need to be reported in an individual’s personal tax return. If the property was owned outside of super, the income from both the rental stream and capital gains on sale of the property would be taxable to the individual who owned the property at their marginal tax rate.

What is Limited Recourse Borrowing?

Why do it?

Many people are unable to generate a sufficient deposit to purchase direct property, as well as the ability to generate surplus cash flow (to pay for a negatively geared property) and difficulties borrowing from banks.

Providing the Trust Deed and Investment Strategy of the Fund are suitable, a Self Managed Super Fund (SMSF) can invest in any asset it chooses, including direct property. SMSFs can also borrow for this purpose, providing the loan is a limited recourse loan for investment purposes, held through a trust (explained below).

How does it work?

The favoured method is via an instalment trust which allows the SMSF to purchase a property and repay the limited recourse loan by instalments. The property is held in the trust for the life of the loan. If the SMSF defaults on payments, the lender’s rights are limited to the property in the trust only. The fund’s loss is then limited to the equity in the property, and the instalments payments made thus far.

What types of property can an SMSF purchase?

An SMSF can purchase any direct property (via auction or private sale) provided it is not purchased from a related party. Property cannot be transferred in-specie from related-party ownership.

Additionally, the purchase of direct property via an SMSF must be for investment purposes only and you cannot receive any other benefit, such as using it as a holiday home.

Business real property can also be purchased via auction or private sale, but unlike residential property, there are no restrictions regarding related party ownership, including in-specie transfer.

Borrowings can be used to purchase, repair, and fund interest expenses. Cosmetic renovations (not an improvement) are permitted with borrowings, and while you can improve a property by adding floor space (granny flat, etc) this must be done using SMSF cash. Off-the-plan purchases are allowable, but not the purchase of land and the subsequent construction of the building.

Additionally, until the SMSF property loan is paid off, alterations to the property cannot be made if they change the character of the property

Things to consider

Diversification

Depending on the total funds available within your SMSF, purchasing direct property may reduce your ability to diversify your portfolio. Lack of diversification can then impact your retirement savings if your property does not perform in line with expectations.

Income Requirements

Direct property often produces less than 5% income return. This may not be an issue whilst the members are still in accumulation mode, however it is worth considering if the members are retired or approaching retirement, as the property may reduce the fund’s cash flow and limit the fund’s ability to make minimum pension payments, as required by legislation.

Additionally, even whilst in accumulation mode, loan repayments must be made from your SMSF which means your fund must always have sufficient liquidity or cash flow to meet the loan repayments.

Liquidation

Property cannot be sold off “bit by bit” like units held in shares can, which can often lead to a forced sale of the entire property if funds are required. Additionally, the sale of property and settlement of the proceeds can be a long process, and this low liquidity means that short term access to cash is limited.

Costs

There are running costs that go with having an SMSF. These include the cost of investing, accounting and auditing for your SMSF, which may be much higher than what you are currently paying particularly if your balance is not very large. The higher your balance, the lower these costs are as a percentage.

Additionally, due to their complexity, SMSF property loans tend to be more costly than other property loans which must be factored into your investment decision.

You should find out all the costs before signing up including:

- Upfront fees

- Legal fees

- Advice fees

- Stamp duty

- Ongoing property management fees

- Bank fees

Insurance in super

Super funds usually offer discounted life and disability insurance. If you set up an SMSF you will have to purchase your insurance separately. Make sure you look into your insurance options before closing your current super account as age and health issues can limit your ability to buy a new policy and can result in increased premiums.

Professional investment management

Are you on top of the investment market? Can you manage a diversified portfolio of investments? Do you know the tax implications?

Super funds use professional managers to invest your super money. Can you do better than the professionals?

Legal responsibilities

All decisions and responsibilities associated with managing the fund rest with you as trustee. In addition, all superannuation funds have to comply with certain rules and certain deadlines. As trustee, you're responsible for making sure the fund meets all legislative requirements on time, so you need to keep up-to-date. You can be penalised for breaches of the legislation.

Possible tax losses

Any tax losses from the property cannot be offset against your taxable income outside the fund.

Super funds usually offer discounted life and disability insurance. If you set up an SMSF you will have to purchase your insurance separately. Make sure you look into your insurance options before closing your current super account as age and health issues can limit your ability to buy a new policy and can result in increased premiums.

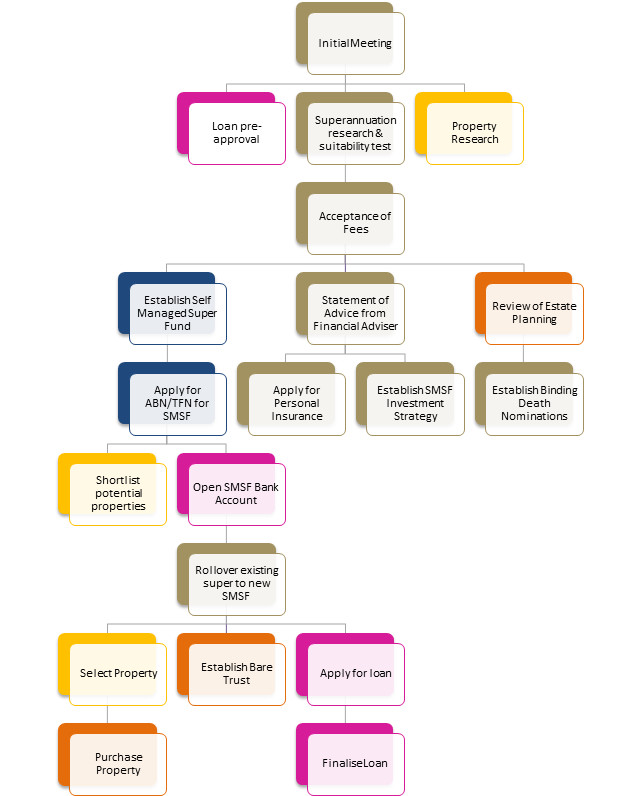

The Process

The strategy of purchasing property within a Self Managed Super Fund (SMSF) is not suitable for every person or every Self Managed Super Fund, and should not be undertaken without a "suitability test" being performed by a Financial Adviser first.

Once you have determined that it is an appropriate strategy for you, we will discuss the fees you are likely to incur throughout the process and once you have accepted these, you can begin your property research and request a loan pre-approval for your estimated loan amount.

Establishing the Self Managed Super Fund (if it is not already in existence) and acquiring a Statement of Advice from a Financial Adviser can take between 2-3 weeks. This is also a good time to review your entire Estate Plan with your solicitor.

Once the SMSF is open, rollovers from your existing super can be processed. This can take up to 4 weeks. You should use this time to shortlist potential properties, ready for your purchase.

Once the rollovers are received you can select your property, establish the Bare Trust and apply for your loan.

The entire process (depending on whether the SMSF is already established or not) usually takes between 4-10 weeks.

Our Team

There are many benefits to purchasing property within a Self Managed Super Fund, but it is a complicated process and therefore it's important to make sure you have a team of professional advisers to guide you along the way.

This is why we have created a "one stop shop" of professional advisers to assist you with the entire investment property purchasing process within an SMSF. From the set up of the Super Fund structure, to loan application, life insurance, financial planning advice and the ongoing administration, your team of professional advisers will help ensure the process is smooth and stress free, and the right fit for your wealth creation strategy.

Our team consists of a mortgage broker (JB Home Loans), and accountant (MGA Accountants), a Financial Adviser (Veracity Wealth Planning), a solicitor (Brereton Lawyers) and a Property Manager and Real Estate Specialist (Jean Brown Properties). Together, we are a collaborative group of professional advisers who will provide you with honest and practical advice in relation to investing in property within super.

Working with a team such as ours means you only need to provide your personal and financial information once, rather than repeat it to several different professionals. We have a seamless process and provide you with good communication about the status of your purchase. We are all small, family owned business and our priority lies with you, our client. We offer transparent fees, so you know exactly how much it's likely to cost before you even begin the process.

Please note that Veracity Wealth Planning is not responsible for the advice and services provided by JB Home Loans, MGA Accountants, Brereton Lawyers or Jean Brown Properties.

The first step in this process is to contact Matt Robertson and Kate Kyle at Veracity Wealth Planning, to discuss your options.

You will need to fill out a simple questionnaire to provide Matt and Kate with information on your current personal and financial situation.

They will then use this information to complete a "suitability test" to ascertain whether you are suitable for a Self Managed Super Fund property purchase, and discuss your details with Jayne Bestt to determine if you are likely for a pre-approval on your loan.

Once this has been determined, they will outline the process and the likely fees, and once you have decided to go ahead, the whole team will become involved.